Send Money Using Aadhaar Number via BHIM App: On December 30th BHIM (Bharat Interface for Money) UPI based app has been introduced by Government of India to encourage cashless transactions. The BHIM App has been introduced by National Payments Corporation of India (NPCI). This app principally works using the Unified Payments Interface (UPI). The BHIM app is supported by maximum number of banks in India. Right now this app got huge public demand and lakhs of Indians are using this app to avail digital transactions. Now, the BHIM App has specially introduced a new feature that is ‘Aadhar based payments’. Now the users can even make their payments, transfer money by using their Aadhar card number. Check the complete details of BHIM Aadhaar payments from the below article.

How to Send Money Using Aadhaar Number via BHIM App – AADHAAR PAY

The BHIM Aadhar payment lets you transfer the money directly to the receiver’s account using the recipient’s Aadhar card number. For this the recipient must have the virtual payment address (VPA) for UPI. Instead of adding the recipient’s bank account details, IFSC code etc details this is the simple process to transfer the money using the Aadhar card thru BHIM App.

When using the ‘BHIP App aadhaar based money transfer’ feature the transfer will be strictly done based on the Aadhar card number. It will not show the recipient’s name, bank account details. So be alert and check the aadhar number twice while attempting to transfer.

Here’s how to send money to Aadhaar numbers via BHIM app:

BHIM app users will now be able to send money using their 12-digit Aadhaar number at places where Aadhaar is listed as a payment option.

1. Open the BHIM app on your phone.

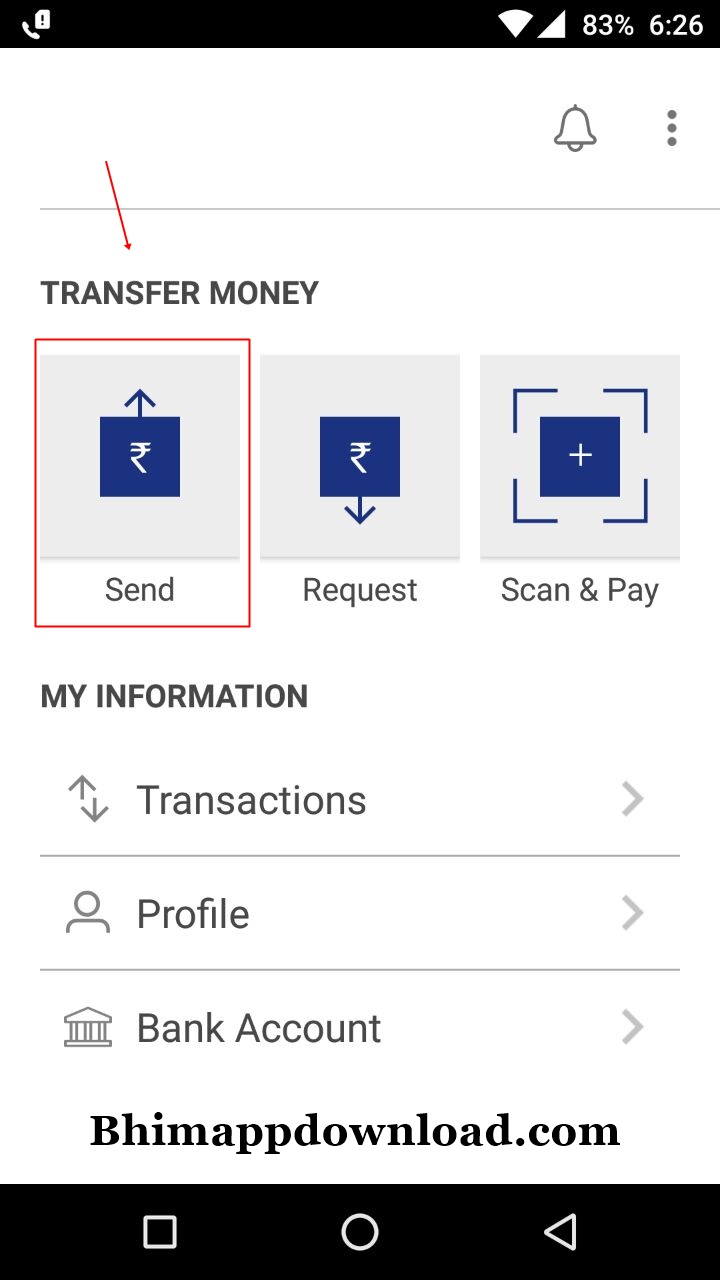

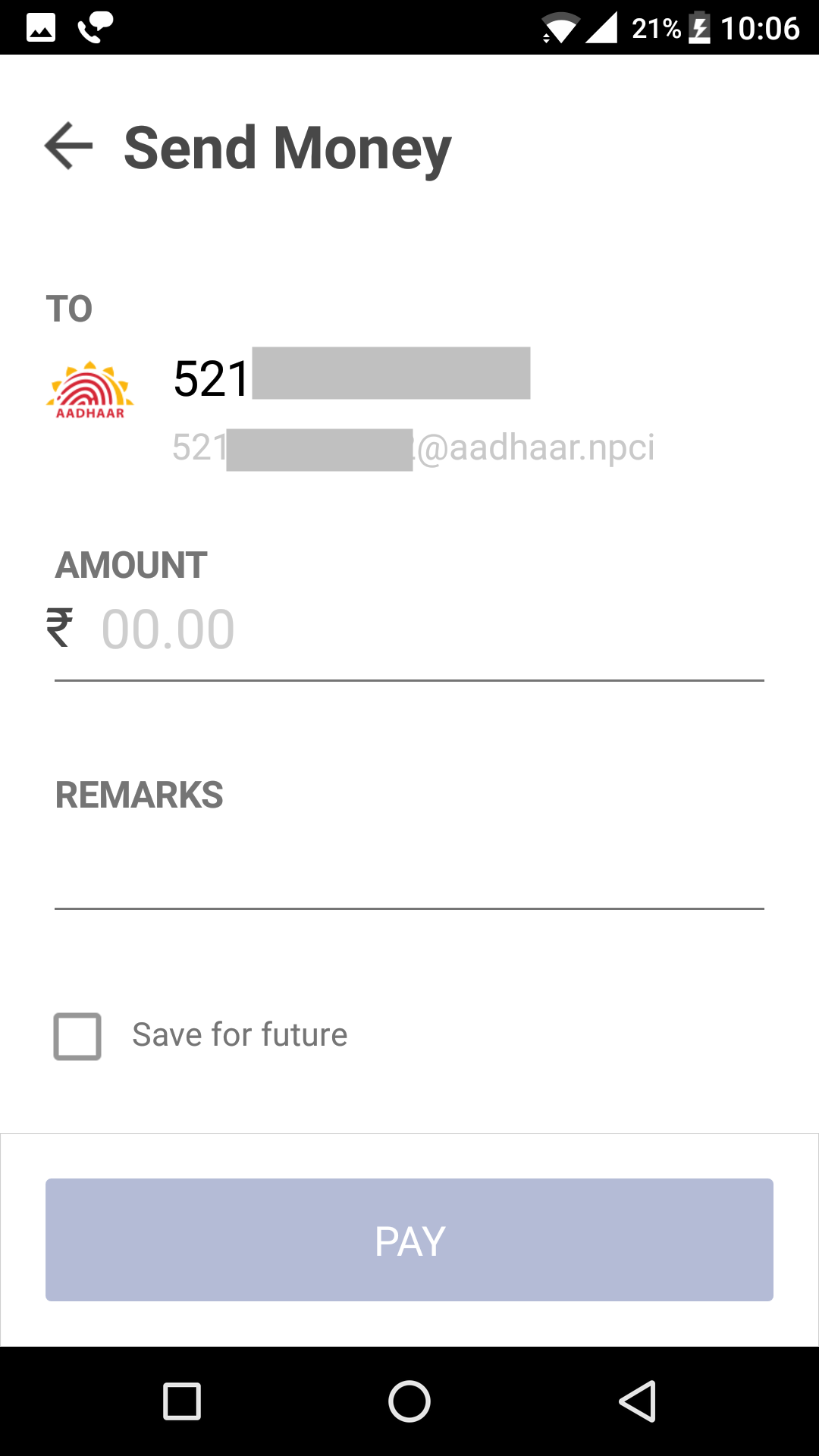

2. Tap Send Money.

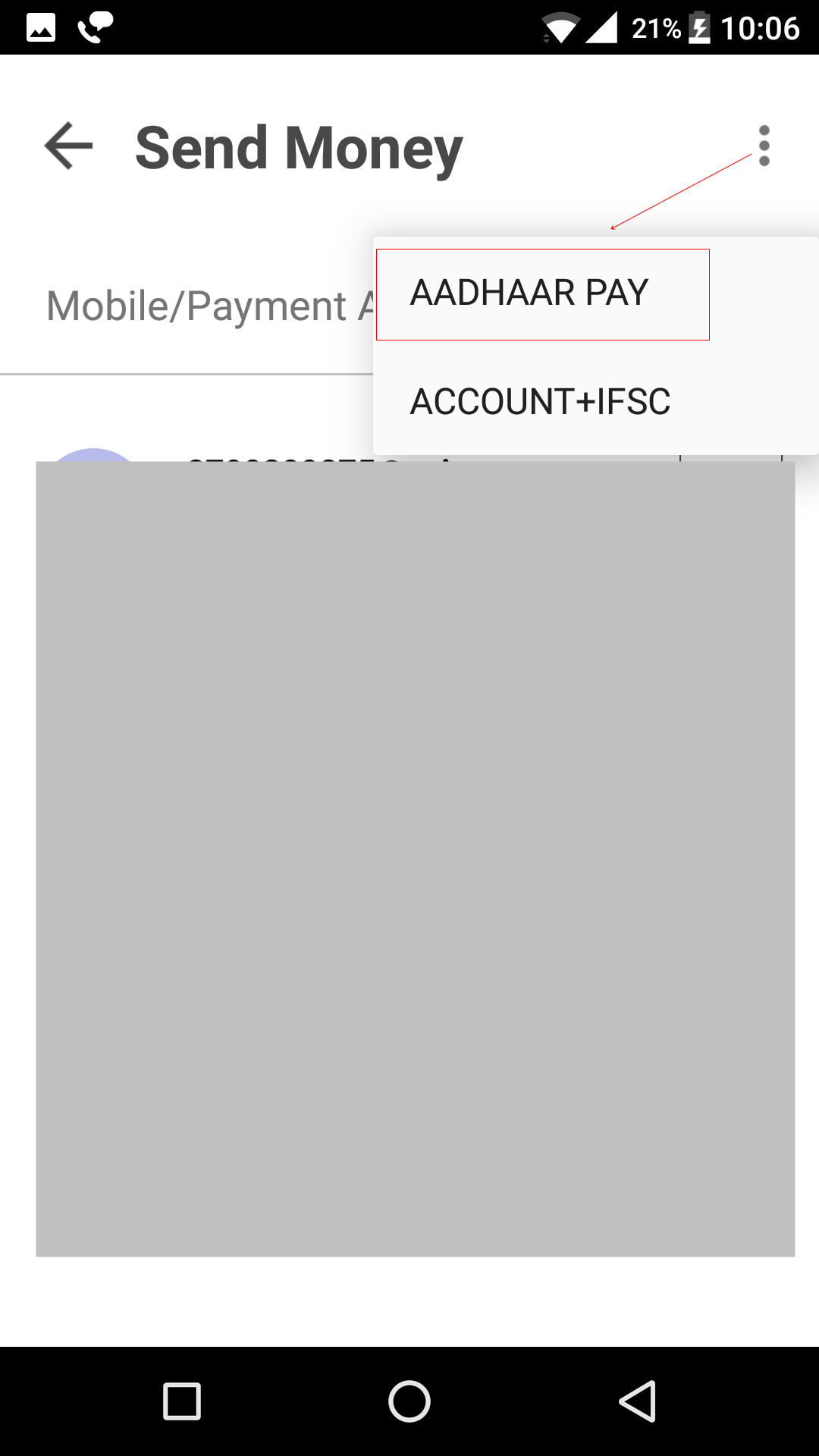

3. Tap the three dots on the top-right. Choose Aadhaar Pay.

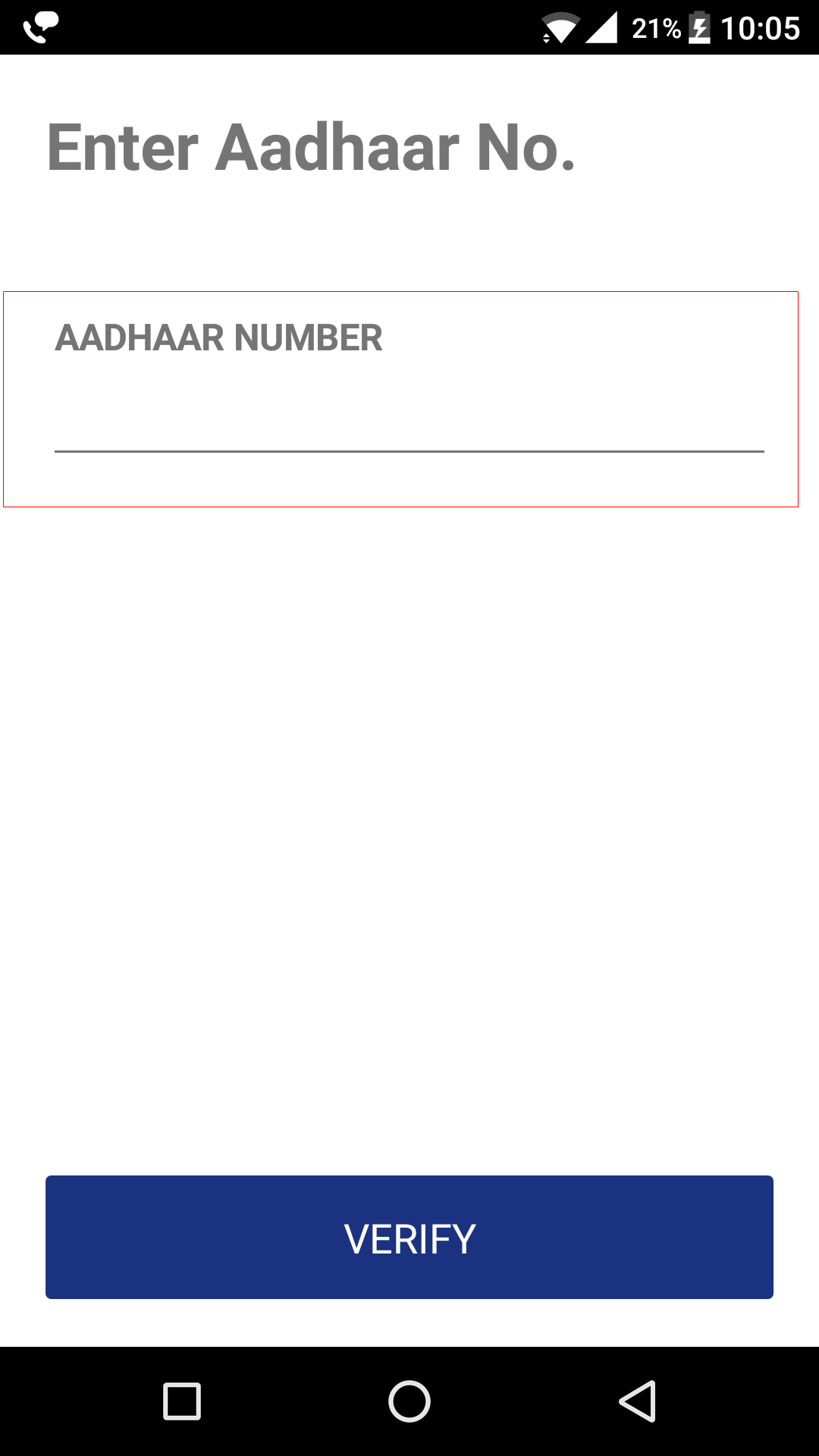

4. Enter the recipient’s Aadhaar number.

5. Tap Verify. This will check if the Aadhaar number is linked to a bank account.

6. The next step will show you the person’s Aadhaar number. Make sure you double-check this as it doesn’t show the account holder’s name.

7. Enter the amount and a reason for payment.

8. Tap Pay.

That’s how you send money to an Aadhaar number via the BHIM app.

the amount of Rs:3500/- has been transferred via Aadhaar.npci on 24 April 2017 at 14:44 Hrs.. But till to day the amount has not been credited to the beneficiary account. From Syndicate Bank to SBM (SBI).

Bank people does not about this. they refused to help. Contacted Head office of NPCI, Mubai, nobody attended the call. I don’t know to whom to approach. Since one month can’t resolved this problem.

Query ID: Aed64cb33c Dt: 24 April 2017 shows, resolved. but not

Devinder kumar mahato

A/c no. 20194321331

15/05/2017 ko

8000 kat gaya

Bank se koi half nahi mila plz

Mo.9023981559

plz refond my money

acount

call me 8482962695

I LIKE TO DOWNLOAD AADHAAR LINK BHIM AAP BUT AAP NOT FOUND

OLD BHIM INSTALL BY ME

HOW MUCH LIMIT FOR PAYMENT & Money Transfer

name:- umesh guruji pathade.

account no:- 416002010121695

branch:- warud

the transaction made to aadhar no on 3rd feb 2017 of 10000 rupees.

here are images attached To the mail of transaction and queries.

contact no:- 7040607072.

Radheyshyam2005@gmail. Conte. 8076954587

Maine bhim app aadhar SE paise bheje unsuccessful hua but paise cut gay aur bank SE koi help nahi mila. UPI/705512651261/[email protected]. Date 24/2/2017

kya hua bhai aapka paisa refund aaya ki nahi

I am use Bhim app transaction but Aadhar pay transaction is not sucess my Transaction is fail &account 4000 rs is decuted please hlep me my transaction is amount is reverse

sir,

i, am a user of your bhim app. the app is good and very useful too. its a very fast app. many people are afraid to use this app frequently because but it has a draw back and it should be corrected. if a moblie with BHIM app is stolen or lost, the person who get the mobile can tranfer funds illegally by login with the OTP. which is very dangerous thing. this can be stopped if the OTP is send only to the other/alternate number of the first owner compulsarily.

and also a time span should be kept say half an hour or one hour before the fund transfer by the OTP and without confirmation from the first owner the fund should not be transferred.